Intel remains bullish on partnership with ARM Holdings

The shares of semiconductor chip manufacturer Intel Corporation (NASDAQ: INTC) recorded a new 12-month high of $36.60 yesterday. So far this year, the shares have appreciated by about 20%. The company reported a 51% decline in the fiscal 2016 second-quarter net income compared to the similar period last year. The revenue increased only 3% on y-o-y basis. Thus, it may look as if the share price has been over stretched by the market. On the contrary, the appreciation in the share price stems from certain valid reasons discussed below.

The shares of semiconductor chip manufacturer Intel Corporation (NASDAQ: INTC) recorded a new 12-month high of $36.60 yesterday. So far this year, the shares have appreciated by about 20%. The company reported a 51% decline in the fiscal 2016 second-quarter net income compared to the similar period last year. The revenue increased only 3% on y-o-y basis. Thus, it may look as if the share price has been over stretched by the market. On the contrary, the appreciation in the share price stems from certain valid reasons discussed below.

The Mountain view, California-based company reported second quarter net income of $1.3 billion or $0.27per share on revenue of $13.5 billion. In the prior year’s similar quarter, the company reported net income of $2.7 billion or $0.55 per share on revenue of $13.2 billion.

On a non-GAAP basis, the Q2 2016 net income decreased to $2.9 billion or $0.59 per share, from $3.1 billion or $0.62 per share in the Q2 2015. The analysts surveyed by Thomson Reuters anticipated the company to report net income of $0.53 per share on revenue of $13.54 billion.

Intel Newsroom

Intel recently acquired Nervana systems, a San Diego based startup company involved in the field of artificial intelligence. The acquisition is expected to strengthen the data center business of Intel.

Intel also launched the 7th generation processor, the 14nm Kaby Lakechip (video above). The next generation processor is already becoming popular for its improved graphics performance and better battery life. Intel is expected to reap the benefits in the upcoming quarters.

The company also provided an impressive fiscal 2016 third-quarter guidance. Intel expects Q3 revenue to increase 3% y-o-y to $14.9 billion. The anticipated revenue reflects a 10.1% sequential increase.

Intel also entered into an agreement with its competitor ARM Holdings (ARMH) to manufacture the latter’s chips for embedded devices in its foundry. By allowing the competitors to make use of the advanced manufacturing facility, Intel is expected to realize additional revenue. The market for IoT (Internet of Things) is expected to be worth about $50 billion by 2020. By partnering with ARM, Intel is expected to realize a huge chunk of additional cash from its foundry business. There was a report in the Nikkei Asian Review that Intel may get the order for its A12 chips from Apple for the iPhone to be launched in 2018. Thus, considering the positives, we expect the share price of Intel to remain upbeat in the current quarter.

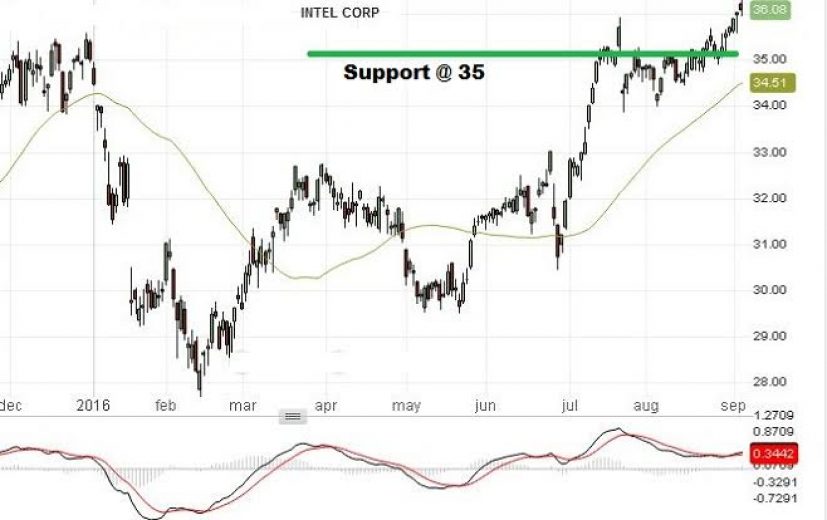

The share price has broken the long-term resistance level of 35. The main line of the MACD indicator has crossed over the signal line and is ascending in the bullish zone (above zero line). Thus, we can anticipate the share price to reach the long-term major resistance level of 42, which also coincides with the target price given by the analysts at the Bank of America.

So, a binary trader can look at the option of purchasing a one touch call option with a target price of about $40. The binary trader should also choose a contract expiry date in the first-week of October.

Related Articles

Stocks Show Signs Of Edging High Despite Investors’ Concerns

The Asian stocks opened on a low during today’s early session and investors also noticed weak equities in the U.S.

Worthington’s Q4 EPS double on YoY basis, tops estimates

Last week, diversified metals manufacturing company Worthington Industries, Inc. (WOR) rose to prominence when the company reported its fiscal 2016

Will Nimbys Thwart the UK Housing Market?

The UK is very eager to start a massive home building program and one aspect to this becoming a reality