BoA signals bearish reversal after going ex-dividend

Since November 2nd , the stock of Bank of America Corporation (NYSE: BAC) has appreciated by about 30% to $21.19, from a low of $16.80.

Since November 2nd , the stock of Bank of America Corporation (NYSE: BAC) has appreciated by about 30% to $21.19, from a low of $16.80.

The Charlotte, North Carolina-based bank reported fiscal 2016 third-quarter earnings of $4.96 billion or $0.41 per share on revenue of $21.635 billion. Both earnings and revenues exceeded the Street estimates.

The Q3 2016 results turned the stock bullish. The victory of Donald Trump provided the additional thrust to the stock’s rally. Based on the details given below, we are forecasting a short-term correction in the stock.

Beginning last Wednesday, the shares of Bank of America are trading ex-dividend. Normally, a stock trades at a premium until the ex-dividend date. After the ex-dividend date, the stock will usually dip as the investors are not entitled to a dividend. So, considering the fact that the stock of BoA has gone ex-dividend last week, we can anticipate a short-term weakness.

Bank of America

The annual yield of BoA comes to around 1.4%, based on the Friday’s closing price of $21.23. The average yield of S&P500 Index is 2%. So, we can infer that the investors’ interest in the stock would decline in the coming days.

The analysts had given a 12-month target price of $18.70 for the stock of Bank of America. This means that the stock would correct soon and align itself in line with the fundamentals.

The data from the recent settlement date indicates that the number of short positions in the market had increased 23% to 148.7 million shares, from 121.1 million shares two weeks before. This indicates that more and more market participants now believe that the stock has appreciated too much in a short span of time.

The Fed is expected to raise the benchmark interest rate later this month. Obviously, this would add several billions of dollars to the top line of the bank. The recent rally indicates that the share price is also reflecting most of the monetary gains that would be generated by the bank due to the rate hike. Thus, a bet on the decline in the share price looks wise at this point in time.

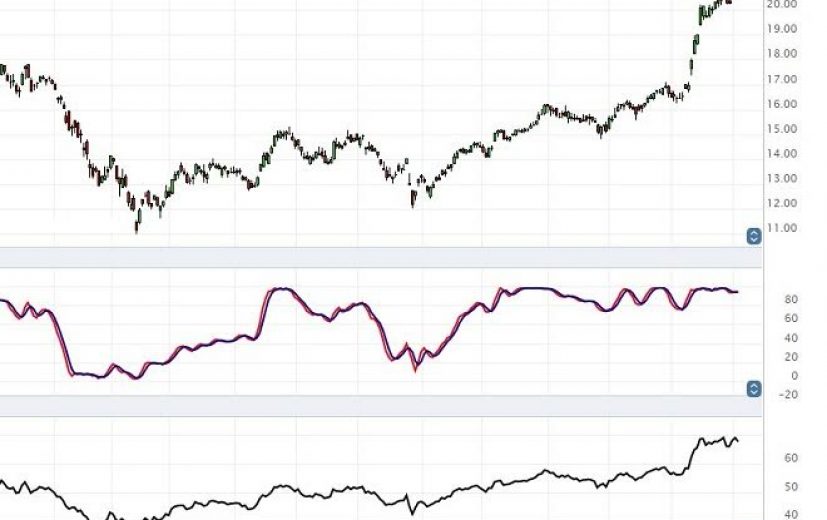

A quick technical analysis will reveal that the stochastic oscillator is already moving in the overbought region. The RSI indicator has also entered the overbought zone. So, this offers a perfect opportunity to open a short position in the stock.

Binary option traders can trade a put option (low or below) to gain from the probable fall in the stock’s price. The entry should be made near the $21.50 levels. As the forecast is for the short-term, the validity of the contract should not extend beyond one week.

Related Articles

King Of Saudi Arabia Announces Subsidy Cuts For 2016 Budget

The Middle East has had a strong economy during the last decade due to it abundant oil reserves but things

Bank of England Releases Stress Test Results

The Bank of England (BoE) conducts financial stress tests on all UK banks on a yearly basis to determine how

BoE Chief Says Britain Must Be Safeguarded From Weak Euro

Key legislators in Britain have always debated over the possibility of distancing themselves and opting out of being a part