United Technologies turns bearish on supply chain issues

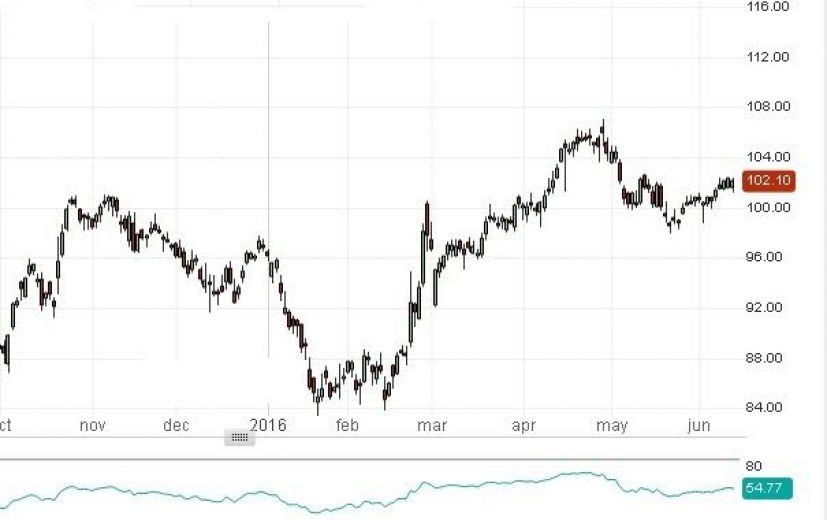

The shares of aircraft engine manufacturer United Technologies Corporation (UTX) have fallen from a high of about $107 to a low of about $98 in the past one and half months.

The shares of aircraft engine manufacturer United Technologies Corporation (UTX) have fallen from a high of about $107 to a low of about $98 in the past one and half months.

The 7% erosion in the value is mainly because of the difficulties faced by the company in the timely procurement of the critical engine parts from its suppliers.

Even though the share price has bounced back to stay marginally above $100, still, analysts believe that the reversal is only temporary because of the following reasons.

The Hartford, Connecticut-based company has spent nearly $10 billion to develop the GTF (Geared Turbo Fan) engine and compete with General Electric Co (GE) in the commercial aviation market. The engine is offered for Airbus’ A320 single-aisle jet and several other planes, including the Bombardier C-Series.

United Technologies Corporation

Pratt & Whitney, the entity that manages the engine business of the United Technologies, claims that it has about 7,000 orders for the engine. However, nearly 44% of the company’s 6000 suppliers are unable to ensure timely delivery and quality control targets of the company. This has put the engine delivery schedules of the company in jeopardy. To avoid the delays, the company has resorted to duplicate manufacturers for engine parts. However, it is yet to yield significant results.

General Electric, the main competitor of United Technologies, is currently in the process of ramping up production of its single-aisle engine, the LEAP, developed under a joint-venture with French engine manufacturer Safran SA. GE holds the largest market share in the single aisle jet category. Both conglomerates do business with the same suppliers. This has put the suppliers under tremendous pressure.

The indicative price of LEAP engine is $13 million. However, aircraft industries pay only $3.7 million for the engines. This corresponds to a whopping discount of about 70% on the listed price. As the research firm Cowen found, to manage the competition, United Technologies had to trim its price for the GTF planes. That was more evident after CFM International (a subsidiary of GE) became the main engine supplier for Boeing 737.

Since new aircrafts are not developed frequently, the engine manufacturers are more concerned with grabbing as many orders as they possibly could as the opportunity will not present again for a long-span of time.

United Technologies also had an issue with its software recently. The software that manages the engine was sending out ‘nuisance messages’ while flying. Similarly, a key engine component had to be tweaked to avoid the need to cool the engine before starting it again.

Thus, fundamentally, the stock can be expected to remain range bound with negative bias, at least until the parts supply issue is sorted out.

The chart history reveals the existence of strong resistance at 105. The RSI indicator is pointed downwards with a reading slightly above 50. The share price has fallen below the 50-day moving average and has begun its journey within a declining channel. Thus, we can expect the share price to test the next support level of 95, or even 85 in the worst case.

So, to make hay while the sun shines, a one touch put option should be bought by a binary trader. A target price of $95 or higher should be selected for the put option trade. Similarly, a one month time frame is recommended for the contract expiry period.

Related Articles

Osborne to Enhance Competitiveness of UK’s Financial Sector

Chancellor George Osborne is planning ways to make UK’s financial service sector more competitive. He will soon announce the re-launch

Greenpeace accuses Coca-Cola of adding to pollution

Higher than anticipated revenue and earnings in Q4-2016 pushed the stock price of Coca-Cola Company (NYSE: KO) to a high

Facebook tops Q3 estimates, operating margin rises to 50%

Despite reporting an exceptional Q3 2017 results that blew away analysts’ estimates, the stock of social media platform provider Facebook,