Mortgage fraud to impact Deutsche bank’s Q4 by $1.2 bln

The Deutsche Bank AG (NYSE: DB) is expected to announce its fiscal 2016 fourth-quarter results around February 4th.

The Deutsche Bank AG (NYSE: DB) is expected to announce its fiscal 2016 fourth-quarter results around February 4th.

The bank anticipates a negative impact of $1.2 billion on the pre-tax profit, following the $7.2 billion penalty paid to the Department of Justice for clearing charges related to the unethical promotion of high-risk mortgage securities.

The German lender’s CEO John Cryan had already asked for an unconditional apology in this regard. The stock, which closed at $19.18 on Friday, looks fairly priced considering the rising interest rate scenario and settlement of major legal issues.

However, we anticipate the bearishness in the stock to continue for the rest of the month due to the reasons provided underneath.

The Next News Network

Last week, a Jewish Charitable trust filed a case against Deutsche bank AG, claiming the bank has wrongly withheld $3 billion from the heirs to a German family. According to Wertheim Jewish Education Trust LLC, the family held money in accounts opened in a branch, which is now under Credit Suisse Group AG. Deutsche bank has denied the claims of Wertheim family.

After suspending annual dividend, considering the penalty levied by the US Department of Justice, the bank announced that it would go ahead and implement its plan of trimming the job count by 9,000 before the end of 2018. The bank has also resorted to cut bonuses of its top executives, apart from trimming the variable compensation of other employees. The management of Deutsche bank has stated that such tough measures are required to bring the bank on growth track. The Common Equity Tier 1 ratio, which reflects the financial health, of the bank is currently 10.76%. As of December 2016, the Goldman Sachs’ CET1 ratio is 13.2%, while that of Bank of America is 11.5%. Similarly Citigroup’s CET1 ratio is 12.5%.

Thus, considering the negative impact on the pre-tax profit in the current quarter and headwinds faced by the bank, we anticipate the stock to remain bearish in the short-term.

A technical resistance is seen in the historic price chart of the stock at the level of $19.30. The main line of the stochastic oscillator is below the signal line. Furthermore, the negative slope of oscillator reflects an underlying weakness in the stock. From the price movement and the indicator levels, we can expect a decline in the share price.

To gain from the forecast, a trader should invest in a put option contract that expires on or around the 1 st of February. The low or below contract, as it is referred by some of the binary brokers, can be bought when the stock of Deutsche bank trades above $19 in the equity market.

Related Articles

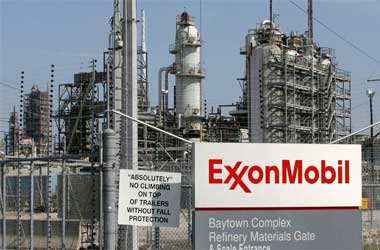

Exxon remains bearish on losses from upstream operations

Despite going past the earnings and revenue estimate of analysts, the shares of ExxonMobil (XOM), the fourth largest company in

Pfizer And Allergan Decide To Merge In A $160 Billion Deal

Pharmaceutical giant Pfizer recently announced that it planned to acquire Allergan Plc, another well known pharmaceutical enterprise that is known

Iron ore rout weakens Rio Tinto

The stock of Rio Tinto Plc lost about 5%, or $1 billion of its market capitalization, last week to close